Transferring an IRA To Gold: A Comprehensive Examine Report

페이지 정보

작성자 Lauri Fison 작성일25-07-10 09:46 조회25회 댓글0건관련링크

본문

Introduction

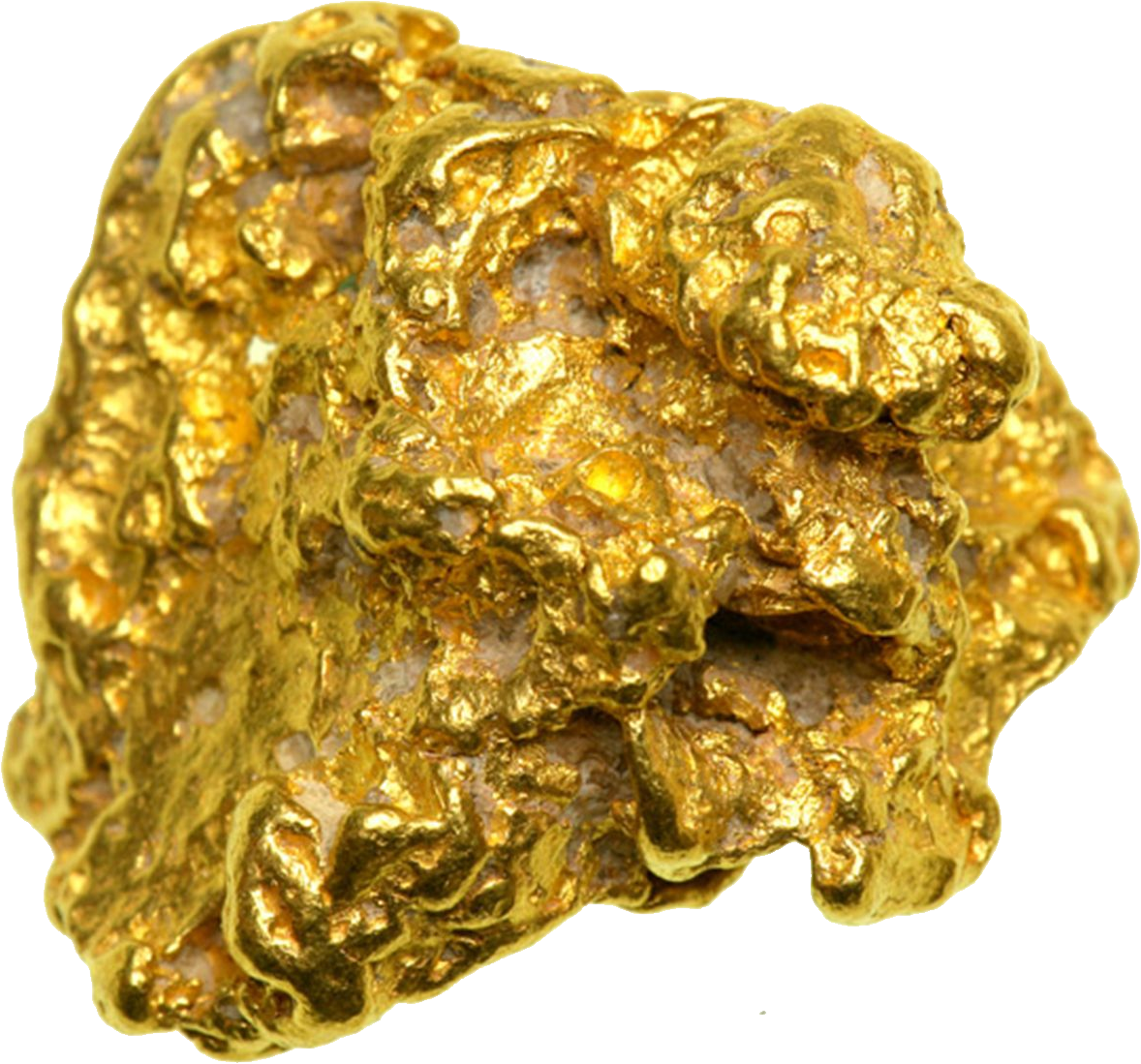

In recent times, the idea of investing in gold has gained vital traction among investors seeking to diversify their portfolios and hedge in opposition to financial instability. When you loved this article as well as you want to acquire details relating to Iragoldinvestments.org kindly check out our web site. One of the simplest ways to spend money on gold is through a Gold IRA, which allows people to switch their current Individual Retirement Accounts (IRAs) into gold and other treasured metals. This report explores the process, advantages, dangers, and issues concerned in transferring an IRA to gold, providing a comprehensive information for potential buyers.

Understanding Gold IRAs

A Gold IRA is a self-directed particular person retirement account that enables buyers to hold bodily gold, silver, platinum, and palladium as part of their retirement savings. Not like conventional IRAs, which typically hold paper assets like stocks and bonds, Gold IRAs provide a possibility to invest in tangible assets that can function a hedge in opposition to inflation and financial downturns.

The Technique of Transferring an IRA to Gold

Transferring an IRA to gold includes several key steps:

- Select a Gold IRA Custodian: Step one is to select a reputable custodian who specializes in Gold IRAs. The custodian will manage the account, handle the purchase of gold, and ensure compliance with IRS rules.

- Open a Self-Directed IRA: Once a custodian is chosen, traders must open a self-directed IRA account. This account permits for the acquisition of different property, together with treasured metals.

- Initiate the Transfer: Buyers can then provoke the switch course of by contacting their present IRA provider and requesting a direct transfer to the brand new Gold IRA. This course of is often tax-free and penalty-free if performed appropriately.

- Select the Gold Products: After the switch is full, buyers can select the forms of gold products they wish to buy. This can embrace bullion coins, bars, or rounds that meet IRS standards.

- Complete the acquisition: The custodian will facilitate the acquisition of the selected gold merchandise, ensuring they are saved in an IRS-accredited depository.

- Maintain Compliance: Traders should adhere to IRS regulations relating to the storage and handling of valuable metals within their Gold IRA to avoid penalties and ensure tax advantages.

Benefits of Transferring an IRA to Gold

- Hedge Against Inflation: Gold has traditionally maintained its worth over time, making it an effective hedge towards inflation and forex devaluation.

- Portfolio Diversification: Investing in gold may help diversify an funding portfolio, lowering general danger by spreading investments across different asset lessons.

- Protection In opposition to Economic Instability: During instances of economic uncertainty, gold often performs nicely, offering a protected haven for traders.

- Tax Advantages: Gold IRAs offer the same tax benefits as traditional IRAs, allowing for tax-deferred growth on investments.

- Tangible Asset: In contrast to stocks and bonds, gold is a bodily asset that traders can hold, offering a sense of safety and possession.

Risks and Considerations

While there are numerous benefits to transferring an IRA to gold, investors should also be aware of the dangers and concerns concerned:

- Market Volatility: The price of gold will be risky, and whereas it may serve as a hedge towards inflation, it isn't immune to market fluctuations.

- Storage and Insurance Prices: Investors must consider the prices related to storing and insuring physical gold, which can affect overall returns.

- Limited Progress Potential: Unlike stocks, gold doesn't generate earnings or dividends, which may limit its growth potential over the long run.

- Regulatory Compliance: Investors should guarantee compliance with IRS laws relating to the acquisition and storage of gold to avoid penalties.

- Custodian Charges: Gold IRA custodians usually cost charges for account administration, which can affect overall funding returns.

Components to consider Before Transferring

Before making the choice to transfer an IRA to gold, buyers ought to consider the following elements:

- Investment Targets: Clearly outline investment goals and the way gold matches into the general strategy. Is the purpose to hedge against inflation, diversify, or seek lengthy-term development?

- Time Horizon: Consider the time horizon for investments. Gold may be extra suitable for long-time period investors in search of stability quite than brief-term good points.

- Monetary State of affairs: Assess the present monetary state of affairs and decide if transferring to gold aligns with total retirement planning.

- Market Conditions: Stay informed about present market situations and trends within the gold market to make an informed decision.

- Consulting Professionals: It may be helpful to consult with monetary advisors or tax professionals to grasp the implications of transferring an IRA to gold.

Conclusion

Transferring an IRA to gold is usually a strategic transfer for investors trying to diversify their retirement portfolios and protect in opposition to economic uncertainties. By understanding the process, benefits, risks, and issues concerned, individuals could make knowledgeable decisions that align with their financial objectives. As with every funding, thorough analysis and skilled steering are important to navigating the complexities of Gold IRAs and guaranteeing a successful transition. With careful planning and consideration, investors can leverage the stability of gold to boost their retirement financial savings and achieve long-term financial safety.

댓글목록

등록된 댓글이 없습니다.